nj property tax relief 2018

New Jersey Property Tax Relief Programs. State Tax Office Website.

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Ad Owe the IRS.

. Ad Prepare your 2018 state tax 1799. Ad See If You Qualify For IRS Fresh Start Program. You May Qualify for an IRS Forgiveness Program.

Applications for the homeowner benefit are not available on this site for printing. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. If your New Jersey Gross Income is.

100 Free Federal for Old Tax Returns. Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or disabled. 2018 Third Round Housing Element and Fair Share Plan.

Reduce Your Back Taxes With Our Experts. End Your Tax Nightmare Now. Property Tax Relief Programs Homestead Benefit.

Free Case Review Begin Online. Local Property Tax Relief Programs. The amount varies according to the amount of the taxpayers NJ taxable income.

Property Tax Relief Forms. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

We will mail checks to qualified applicants as. Property Tax Relief Forms. Ad Prepare your 2018 state tax 1799.

The New Jersey tax credit is a percentage of the taxpayers federal child and dependent care credit. State Tax Office 75 Veterans Memorial Drive East Suite 103 Somerville NJ 08876. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

Water and Sewer Rules and Policy Manuals. Based On Circumstances You May Already Qualify For Tax Relief. On January 1 2017 the tax rate decreased from 7 to 6875.

Credit on Property Tax Bill. 21 2018 344 pm. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

New Jerseys residential property taxes set a new record in 2017 with the average annual tax bill now at 8690 -- or 725 a month. New Jersey Tax-Resolution Program. Civil Union Act Implementation.

The Homestead Benefit program provides property tax relief to eligible homeowners. 100 Free Federal for Old Tax Returns. Applications for the homeowner benefit are not available on this site for printing.

Local Property Tax Forms. The State of New Jersey has provided a web page for residents to access information about. Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018.

The average property tax bill in 2018 was 8767 a 77 increase over the 8690 bill. Get the Help You Need At Best Company. Compare 1000s Of Ratings On Tax Companies Online.

New Jerseys Property Tax Relief Programs. Prior Year Homestead Benefit Calculations. Prepare and file 2018 prior year taxes for New Jersey state 1799 and federal Free.

Prepare and file 2018 prior year taxes for New Jersey state 1799 and federal Free. Property Tax Relief Programs. Your benefit payment according to the Budget appropriation is calculated by.

We will mail checks to qualified applicants as. 3 rows If your 2018 New Jersey Gross Income is. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Ad Dont Know Where To Start When It Comes To Taxes. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program. 2018 Form PTR-1 New Jersey Senior Freeze Property Tax Reimbursement Application File your application by October 31 2019 For more information call 1-800-882-6597 IMPORTANT.

How To Fill Out A W 4 A Complete Guide Tax Mistakes Tax Debt Income Tax Return

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

State Local Property Tax Collections Per Capita Tax Foundation

The Federal Geothermal Tax Credit Your Questions Answered

Tax Benefits Available For Victims Of Natural Disaster The Turbotax Blog

What Is The Irs Form 2106 Turbotax Tax Tips Videos

Casino Suffolk Downs Uninterested In Boston Casino Regardless Of Wynn Resorts Suitability Outcome Resort Suffolk In Boston

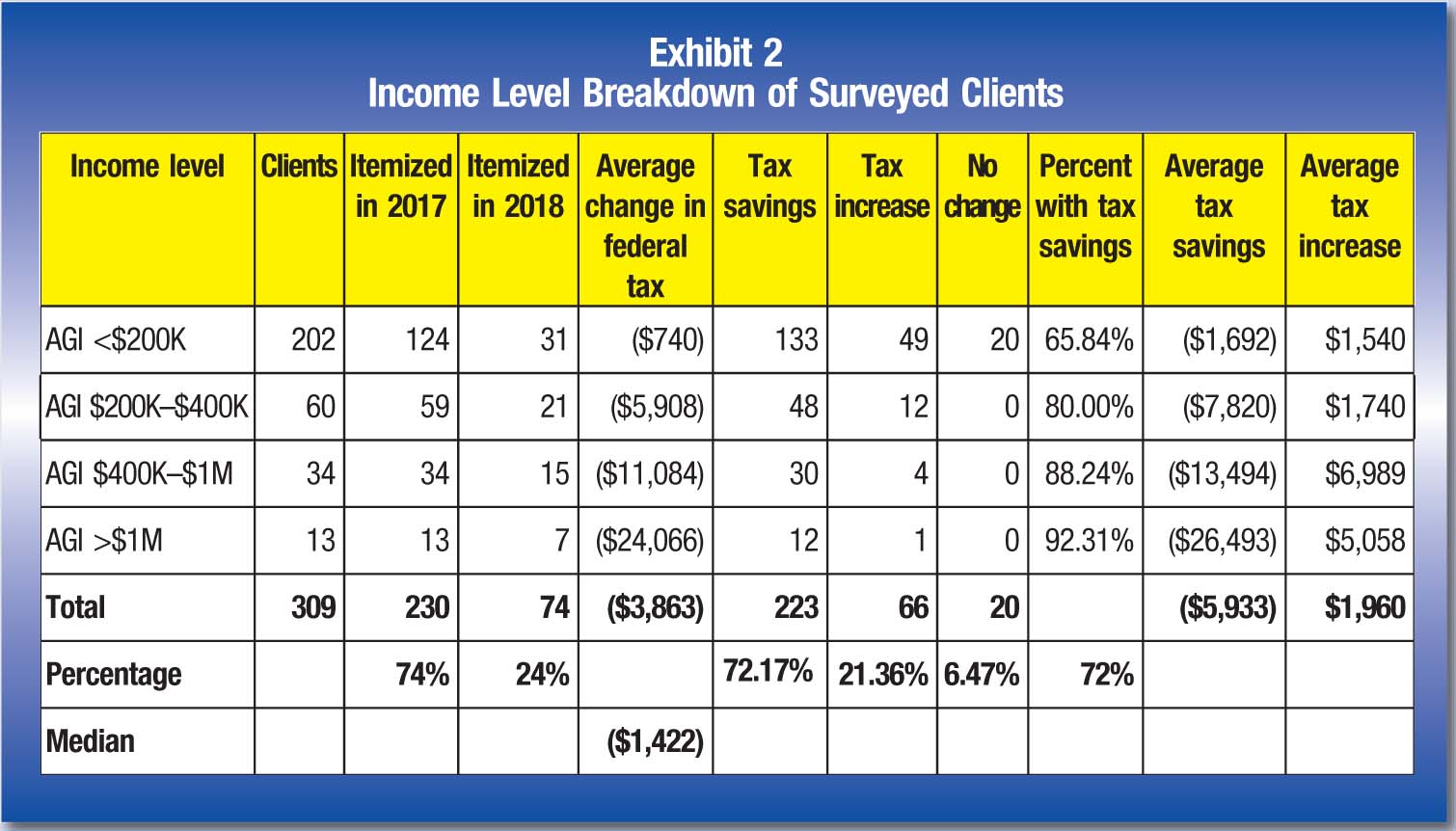

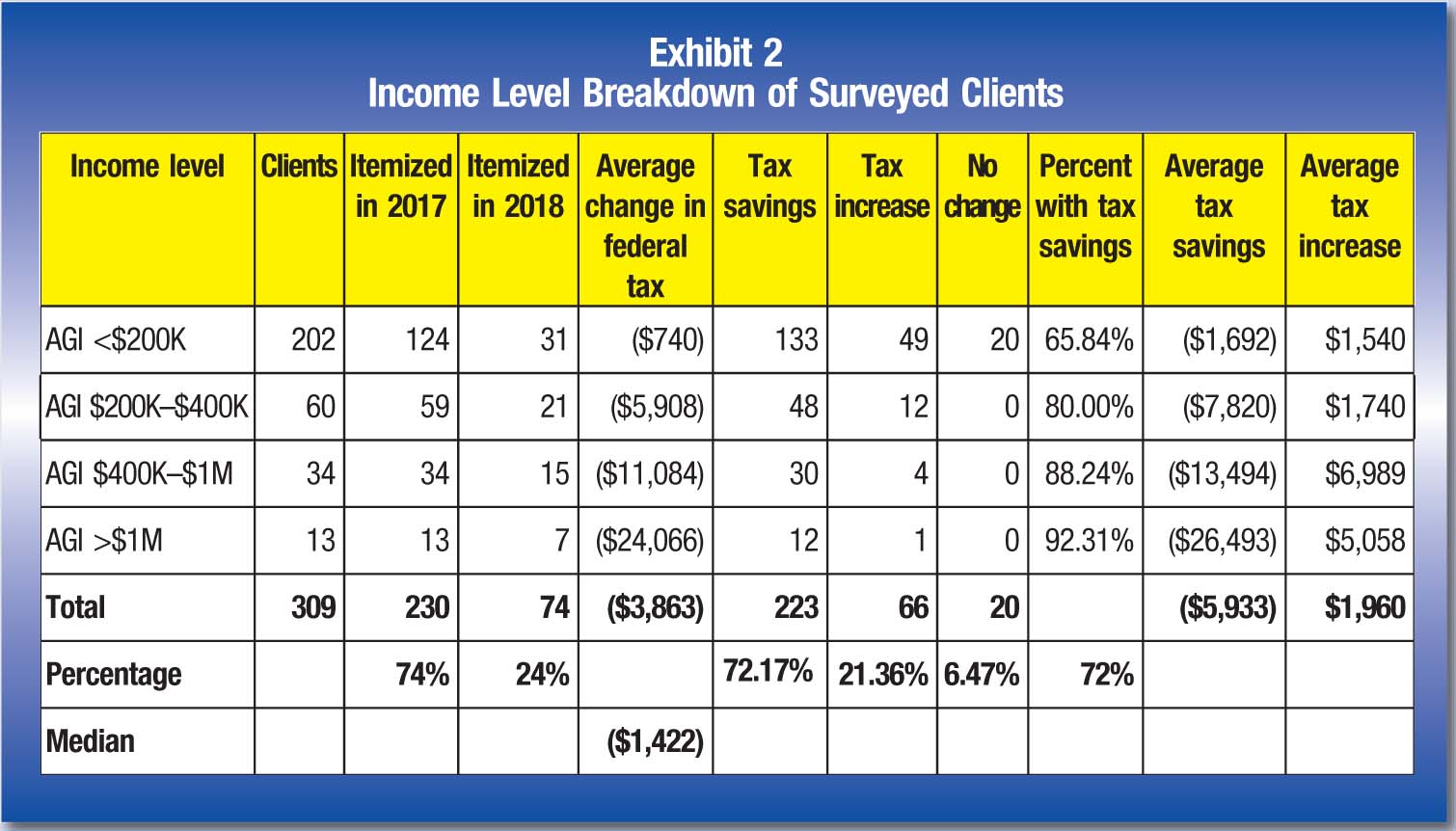

Examining The 2017 2018 Tax Law Changes The Cpa Journal

How To Collect And Pay Sales Tax In Quickbooks Desktop Youtube

Foreign Companies Expat Tax Professionals

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

Vehicle Sales Tax Deduction H R Block

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Examining The 2017 2018 Tax Law Changes The Cpa Journal

Examining The 2017 2018 Tax Law Changes The Cpa Journal